Accurate bookkeeping is the bedrock of any thriving business. Beyond simple record-keeping, it provides a clear, real-time snapshot of financial health, enabling informed decision-making and strategic growth. By meticulously tracking income and expenses, businesses gain crucial insights into profitability, cash flow, and potential areas for improvement. This precision not only minimizes costly errors and tax liabilities but also fosters trust with stakeholders, ensuring long-term stability and success.

Professional business bookkeepers play a pivotal role in streamlining this complex process. They alleviate the burden of financial management, allowing business owners to focus on core operations. Through services like meticulous transaction categorization, regular reconciliation, and the generation of comprehensive financial reports, bookkeepers ensure accuracy and compliance. Their expertise extends to managing accounts payable and receivable, payroll, and tax preparation, providing a holistic approach to financial oversight. These services are essential for businesses of all sizes, offering clarity, control, and peace of mind in navigating the financial landscape.

Choosing the Right Bookkeeping System

Selecting the appropriate bookkeeping system is crucial for efficient financial management. Businesses face a fundamental choice between manual and digital methods. Manual bookkeeping, while seemingly simple, is prone to errors, is time-consuming, and lacks real-time insights. Conversely, digital systems, particularly cloud-based solutions, offer automation, accuracy, and streamlined processes. Choosing the right software, often guided by experienced business bookkeepers, involves evaluating features like invoicing, expense tracking, and reporting capabilities, ensuring they align with the business’s specific needs and growth trajectory.

Among the digital options, various popular bookkeeping software platforms stand out, often favored by professional bookkeepers for their robust features and user-friendly interfaces. Cloud-based solutions further enhance accessibility and security, allowing for real-time collaboration and data backup. This means financial information is accessible from anywhere, fostering better decision-making and reducing the risk of data loss. By leveraging these advanced tools, businesses can achieve a more organized, efficient, and secure financial management system, ultimately contributing to their overall success.

Best Practices for Maintaining Accurate Records

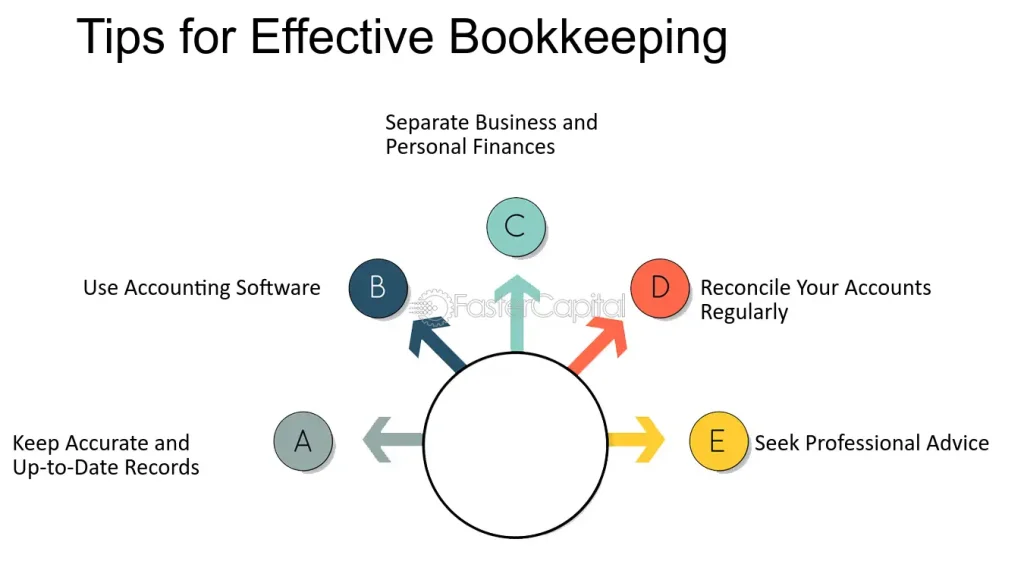

Maintaining accurate financial records is paramount for any business, and establishing best practices is essential for this. This involves meticulous organization of all financial documents, including receipts, invoices, and bank statements. A well-structured system, whether digital or physical, ensures that every transaction is readily accessible and properly categorized. This systematic approach not only facilitates efficient tracking of income and expenses but also provides a clear audit trail, crucial for financial transparency and accountability.

Regular account reconciliation is another critical practice, ensuring that internal records align with external bank statements and other financial documents. This process helps identify discrepancies, prevent fraud, and maintain accurate financial reporting. Furthermore, a skilled bookkeeper plays a vital role in ensuring compliance with tax regulations. Their expertise in understanding and applying relevant tax laws minimizes the risk of penalties and optimizes tax liabilities. By adhering to these best practices, businesses can achieve financial accuracy, compliance, and peace of mind.

Outsourcing vs. In-House Bookkeeping

Deciding between outsourcing and in-house bookkeeping involves weighing the advantages and disadvantages of each approach. Hiring professional bookkeepers, whether through an agency or as freelancers, offers access to specialized expertise without the overhead costs associated with full-time employees. This can translate to significant savings in salaries, benefits, and training. Moreover, outsourcing provides flexibility, allowing businesses to scale their bookkeeping services as needed. Professional bookkeepers also bring an objective perspective, ensuring accuracy and compliance, and often utilize advanced software that smaller businesses might not otherwise access.

When comparing costs, in-house bookkeeping includes not just salaries but also software licenses, office space, and ongoing training. Outsourcing, on the other hand, typically involves a fixed fee or hourly rate, making it more predictable and manageable for budgeting. To choose the right bookkeeper in USA, businesses should assess their specific needs, consider the bookkeeper’s experience and qualifications, and ensure they have a strong understanding of US tax laws and regulations. Clear communication and a good cultural fit are also essential for a successful working relationship. Seeking recommendations and reviewing testimonials can further aid in making an informed decision.

Key Bookkeeping Strategies for Different Business Sizes

Tailoring bookkeeping strategies to the specific needs of different business sizes is crucial for effective financial management. Small businesses often benefit from simplified methods and automation tools, such as user-friendly accounting software, to streamline tasks like invoicing and expense tracking. This approach helps them maintain accurate records without overwhelming their limited resources, allowing them to focus on core operations. By leveraging these tools, small businesses can ensure financial clarity and compliance while minimizing administrative burdens.

As businesses grow into medium-sized enterprises, the complexity of their financial operations increases. Streamlining payroll and expense tracking becomes paramount to managing a larger workforce and more intricate financial transactions. Implementing robust payroll software and detailed expense reporting systems enables these businesses to maintain accuracy and efficiency. Large enterprises, on the other hand, require advanced reporting and financial analysis capabilities. This includes generating detailed financial statements, conducting in-depth variance analyses, and developing sophisticated forecasting models. These advanced strategies empower large businesses to make informed strategic decisions, optimize financial performance, and ensure compliance with complex regulatory requirements.

Tax Compliance and Financial Reporting

Tax compliance and accurate financial reporting are critical for any business, and bookkeepers play a vital role in ensuring both. Their expertise in organizing financial data and preparing accurate records is essential for smooth tax preparation. By meticulously tracking income and expenses, and understanding the nuances of tax laws, bookkeepers help businesses minimize tax liabilities and avoid costly penalties. This proactive approach not only saves businesses money but also reduces the stress and uncertainty associated with tax season.

However, common bookkeeping mistakes, such as neglecting to reconcile accounts or misclassifying transactions, can lead to significant tax issues. Professional bookkeepers services mitigate these risks by implementing rigorous internal controls and staying up-to-date with ever-changing IRS regulations. They ensure that all financial records are accurate, complete, and compliant, providing businesses with peace of mind and safeguarding them from potential audits. By leveraging the expertise of professional bookkeepers, businesses can navigate the complexities of tax compliance with confidence and maintain a healthy financial standing.

Leveraging Bookkeeping for Business Growth

Bookkeeping transcends mere record-keeping; it’s a powerful tool for driving business growth. By meticulously analyzing financial data, businesses gain invaluable insights into their performance, identifying trends, and pinpointing areas for improvement. This data-driven approach empowers informed decision-making, allowing businesses to optimize resource allocation, refine pricing strategies, and capitalize on emerging opportunities. Understanding where money flows and where it’s being spent allows for strategic adjustments, fostering sustainable expansion.

Furthermore, leveraging bookkeeping insights is crucial for improving cash flow, the lifeblood of any business. By closely monitoring accounts receivable and payable, businesses can proactively manage their finances, ensuring they have sufficient liquidity to meet operational needs and invest in growth initiatives. A bookkeeper’s expertise becomes indispensable when scaling operations, as they can provide accurate financial forecasts, identify potential bottlenecks, and ensure the business remains financially sound during periods of rapid expansion. Their ability to maintain meticulous records and provide clear financial reports is essential for attracting investors and securing funding, ultimately facilitating the business’s journey toward long-term success.

Final Thoughts

In essence, effective bookkeeping strategies, encompassing accurate record-keeping, strategic software utilization, and diligent tax compliance, form the financial backbone of any successful business. These strategies, tailored to the specific needs of varying business sizes, transform raw financial data into actionable insights, enabling informed decision-making and sustainable growth. By prioritizing these practices, businesses can minimize risks, optimize cash flow, and maintain financial clarity, ultimately fostering stability and profitability.

Professional bookkeepers bring invaluable expertise to this process, acting as trusted financial partners. Their services extend beyond mere data entry, encompassing meticulous analysis, regulatory compliance, and strategic financial planning. Investing in professional bookkeepers’ services is not an expense, but a strategic investment in long-term success. By entrusting financial management to skilled professionals, business owners can focus on core operations, confident that their financial health is in capable hands, paving the way for sustained growth and prosperity.