Introduction to Financial Planning

The journey towards financial freedom is often riddled with complexities and uncertainties. However, with the implementation of rigorous financial planning and analysis, individuals and businesses alike can navigate the treacherous waters of economic fluctuations to ensure sustained growth and security. The management of financial assets and the strategic planning of future investments are pivotal to any wealth accumulation endeavour.

Understanding Financial Planning Services

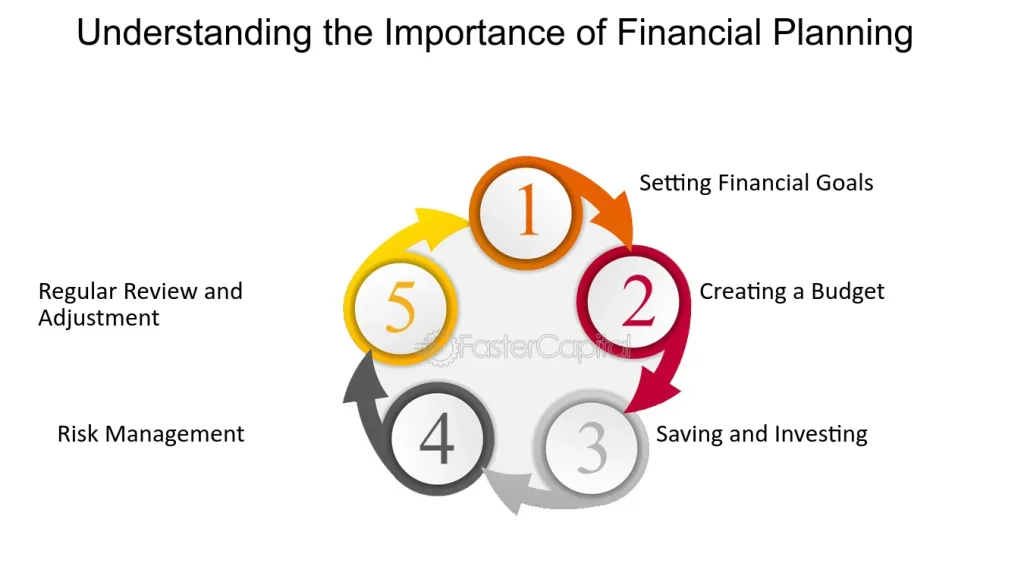

At the core of wealth management, financial planning services offer a structured and strategic approach to managing finances. This includes assessing the current financial status, setting realistic financial goals, and crafting a road map to achieve those goals. The services span various domains, including investment advice, tax planning, estate planning, and risk management.

Financial Planning and Analysis: The Growth Catalyst

The intrinsic value provided by financial planning and analysis cannot be overstated. It involves a deeper evaluation of an individual’s or company’s financial health, providing a detailed comprehension of the capital structure, investment performance, and the potential risks and opportunities. With a thorough analysis, financial planning becomes a catalyst for informed decision-making and strategic growth.

Building a Strong Financial Foundation

A robust financial plan lays the groundwork for long-term wealth accumulation. It begins with the fundamental understanding of one’s income, expenses, debt, and savings. Financial planning encompasses budgeting with precision and proactively managing debt to create a sound financial base from which wealth can grow.

Targeted Investment Strategies

Investment is often the engine room of wealth creation. Through financial planning, individuals and businesses can identify the most suitable investment avenues that align with their risk tolerance and time horizon. Specialists in financial planning assist in constructing a diversified investment portfolio designed to maximise returns while minimising risk.

The Role of Risk Management

Risk is an inherent element in the world of finance. Effective financial planning includes identifying potential risks and employing strategies to mitigate them. Insurance and hedging strategies serve as safety nets in the event of unforeseen circumstances, preserving wealth and ensuring continuity.

The Importance of Regular Reviews and Adjustments

Financial planning is not a ‘set-and-forget’ strategy. It requires continuous monitoring and adjustments to stay aligned with changing financial landscapes and personal circumstances. Regular reviews of financial plans ensure that they remain relevant and dynamic enough to adapt to life’s uncertainties.

Long-term Financial Goals and Retirement Planning

One of the most significant aspects of financial planning is preparing for the future, particularly with respect to Retirement planning. A comprehensive retirement strategy anticipates future living expenses, healthcare costs, and ensures a consistent income stream after retirement.

Tax Efficiency as a Wealth-building Strategy

Optimising for tax efficiency can have a substantial impact on net wealth. Financial planning involves strategic tax planning to reduce liabilities through tax-advantaged investments and opportunities, allowing more wealth to be retained and reinvested for growth.

The Benefit of Professional Financial Planning

While there is a wealth of information available for the DIY investor, the complexity of financial markets makes professional financial planning services valuable. Financial advisors offer expertise and experience, providing personalised advice and strategies tailored to an individual’s unique financial profile and goals.

Technology and Financial Planning

The advent of technology in the financial sector has revolutionised financial planning and analysis. Robo-advisors, online platforms, and software tools have made it easier to manage portfolios, track spending, and forecast future wealth scenarios, allowing for more efficient financial planning.

Understanding Financial Products and Regulations

Sound financial planning also involves a thorough understanding of various financial products and current regulations. Navigating the complex web of investment products, retirement accounts, and regulatory requirements is critical in making informed financial decisions.

The Personal Touch in Financial Planning

While technology has its merits, the personal touch provided by human advisors in financial planning services is irreplaceable. Professional advisors build relationships with their clients, understanding their fears, aspirations, and unique life situations, leading to more nuanced and empathetic financial guidance.

Conclusion: Towards a Secure Financial Future

Financial planning and analysis stand as cornerstones of wealth management and growth. It provides the structure, clarity, and discipline required to navigate through the complexities of financial decisions and market conditions. Incorporating a mix of short-term actions and long-term strategies enables individuals to achieve their financial objectives and secure a prosperous future. It is the meticulous curation of these plans and analyses that help pave the way towards sustained wealth accumulation and a secure retirement.

Final Thoughts

In conclusion, the multi-faceted approach of comprehensive financial planning, including investment tactics, risk management, and tax planning, is critical in growing and protecting wealth. This strategic approach, often best navigated with the help of professional financial planning services and periodic analysis, is fundamental to achieving the financial independence and security that many strive for.