Retail trading has changed dramatically over the past decade. Access to advanced platforms, real-time data, and global markets has leveled the playing field in ways that would have been unthinkable twenty years ago. Yet one barrier remains constant: capital. Most traders don’t fail because they lack ideas. They fail because they lack sufficient capital or risk it poorly.

That’s where the modern prop firm model enters the picture.

Proprietary trading firms have built structured ecosystems that allow individuals to trade with firm capital under clearly defined rules. In exchange, the firm manages risk centrally and shares profits through predetermined payout models. On the surface, it may look simple: pass an evaluation, trade the firm’s money, and receive a share of profits. Underneath, however, there’s a carefully engineered system designed to balance opportunity with strict risk control.

Understanding how these firms structure risk and payouts reveals why the model works, how traders can thrive within it, and why discipline sits at the heart of everything.

What Is a Prop Trading Firm?

A proprietary trading firm uses its own capital to trade financial markets. Traditionally, firms like Jane Street or DRW Trading hired in-house traders, providing capital, infrastructure, and risk oversight in exchange for a share of profits.

The modern retail-facing prop firm model has evolved. Instead of hiring full-time employees, firms evaluate independent traders through structured challenges. Traders who meet predefined performance metrics gain access to funded accounts. From there, profits are split according to the firm’s payout agreement.

This structure aligns incentives. The trader benefits from increased capital and earning potential. The firm benefits from disciplined traders who generate consistent returns while operating within strict risk limits.

The Core Philosophy: Risk First, Profit Second

Every legitimate prop firm is built on a simple principle: protect capital above all else.

Retail traders often focus on returns. Prop firms focus on risk containment. That difference shapes everything from evaluation challenges to payout timing.

Risk management at the firm level generally revolves around:

- Maximum drawdown limits

- Daily loss limits

- Position sizing constraints

- Leverage restrictions

- Trade duration rules

These aren’t arbitrary restrictions. They are protective layers designed to prevent catastrophic loss and ensure traders operate with consistency rather than impulsiveness.

In other words, firms reward behavior that resembles institutional trading standards rather than high-risk speculation.

Evaluation Models: Proving Discipline Before Capital

Most retail-focused prop firms use an evaluation phase. This serves two main purposes:

- Filter out undisciplined traders

- Verify that traders can follow structured risk rules

A typical evaluation includes:

- Profit target, often 8–10%

- Maximum total drawdown, often 10%

- Daily drawdown cap, typically 4–5%

- Minimum trading days

The goal isn’t simply to hit a profit number. The goal is to do so while respecting strict boundaries.

This structure eliminates reckless strategies. A trader who risks 5% per trade might reach the target quickly, but one losing streak would breach daily limits. The model naturally favors controlled, systematic trading approaches.

By the time a trader passes evaluation, the firm has already observed behavioral patterns. Consistency, emotional discipline, and rule adherence matter more than a single large win.

Drawdown Models: Static vs. Trailing

Drawdown is the cornerstone of risk management in a prop firm environment. There are typically two common structures.

Static Drawdown

With static drawdown, the maximum loss threshold remains fixed. For example, on a $100,000 account with a 10% drawdown, the account cannot fall below $90,000 at any time.

This model provides clarity and predictability. Traders know their absolute risk boundary from day one.

Trailing Drawdown

Trailing drawdown adjusts upward as profits increase. If a trader grows the account to $105,000, the drawdown threshold may rise accordingly. However, once it locks at a certain level, it no longer trails beyond that peak.

Trailing models encourage steady upward growth. They discourage aggressive scaling early on because a sharp retracement can trigger violations.

Both models exist to serve the same purpose: limit downside while allowing sustainable upside.

Position Sizing Rules and Leverage Caps

Prop firms rarely allow unlimited leverage, even in markets like forex or futures where brokers may offer high ratios.

Why? Because leverage magnifies both gains and losses.

Position sizing rules often include:

- Maximum lot sizes

- Maximum contract counts

- Scaling limits tied to account growth

- News trading restrictions

By enforcing these rules, firms prevent traders from overexposing capital during volatile events such as central bank announcements from entities like Federal Reserve or European Central Bank.

In practical terms, this ensures one unpredictable event doesn’t wipe out firm capital.

The Payout Model: Aligning Incentives

Once funded, traders earn through profit splits. The structure may vary, but common arrangements include:

- 70/30 split

- 80/20 split

- 90/10 split for experienced traders

If a trader earns $10,000 in profit under an 80/20 split, they receive $8,000 while the firm retains $2,000.

At first glance, some traders question why firms keep a percentage. The answer lies in risk allocation and infrastructure costs. The firm provides capital, technology, risk monitoring systems, compliance structures, and operational support.

Profit splits ensure both parties remain aligned. The trader benefits from performance. The firm benefits from disciplined profitability.

Scaling Plans: Increasing Capital Over Time

One of the most attractive features of modern prop firms is scaling.

Scaling plans typically allow traders to increase account size after meeting performance milestones. For example:

- Generate 10% profit over three months

- Maintain consistent risk metrics

- Avoid rule violations

If successful, a $100,000 account might scale to $200,000 or more.

This creates a long-term growth pathway. Traders who prove consistency gain access to larger capital pools without risking personal funds.

Scaling reinforces the same philosophy seen in institutional trading environments: trust is earned through disciplined performance.

Risk Monitoring Technology

Behind the scenes, prop firms rely on advanced analytics to monitor traders in real time.

These systems track:

- Intraday drawdown

- Trade duration

- Correlated positions

- Exposure concentration

- Volatility spikes

Technology flags behavior that deviates from firm policy. This protects capital and ensures rule enforcement is objective rather than emotional.

Many firms integrate third-party trading platforms, but overlay proprietary dashboards to maintain centralized risk oversight.

The result is a controlled environment where risk is measured continuously rather than periodically.

Psychological Risk Management

Risk models are mathematical. But trading is psychological.

Prop firms structure rules in ways that shape trader behavior. Daily loss limits, for instance, force traders to stop trading after reaching a threshold. This prevents emotional revenge trading.

Similarly, minimum trading days prevent one-day luck from passing evaluation. The trader must demonstrate consistent execution.

Over time, these guardrails train discipline. Traders adapt their strategies to fit within the framework, which often improves long-term stability even outside the prop environment.

Why Firms Can Afford High Payout Splits

A common question arises: if firms pay 80–90% of profits, how do they remain profitable?

The answer lies in statistical distribution.

Not every trader passes evaluation. Of those who pass, not all maintain consistent profitability. Evaluation fees and account resets contribute to firm revenue streams. Meanwhile, consistently profitable traders generate steady returns for the firm’s share.

The firm operates on portfolio theory. Across hundreds or thousands of traders, risk is diversified.

This mirrors institutional risk management concepts used by large trading organizations.

Transparency and Trust

Because traders operate remotely, trust is crucial.

Clear documentation of:

- Risk rules

- Payout timelines

- Withdrawal methods

- Scaling terms

helps maintain credibility.

Reputable firms pay on fixed schedules, often bi-weekly or monthly. Some even offer on-demand payouts after minimum thresholds are met.

When payout reliability is strong, traders can focus purely on performance rather than administrative uncertainty.

Balancing Opportunity and Restriction

Critics sometimes argue that strict rules limit profitability. There’s some truth in that. A trader seeking aggressive 50% monthly returns won’t thrive under prop firm constraints.

But that’s the point.

The structure favors sustainable growth over explosive gains. It filters for traders who can operate like risk managers, not gamblers.

In many ways, prop firm risk models resemble institutional trading desks more than retail brokerage environments.

The Evolution of the Retail Prop Model

The surge in retail prop firms reflects broader trends in financial accessibility. Online trading platforms, improved liquidity, and remote infrastructure have made distributed trading viable.

While traditional firms like Jane Street still operate with elite in-house teams, retail-facing models democratize access to capital.

The underlying risk logic remains consistent: capital preservation first, profit sharing second.

What has changed is the accessibility. Traders no longer need to relocate to financial hubs to gain exposure to institutional capital structures.

Is the Model Sustainable?

Sustainability depends on three factors:

- Transparent risk controls

- Reliable payouts

- Balanced evaluation standards

If evaluation targets are unrealistically high relative to drawdown limits, traders may feel incentivized to gamble. Conversely, realistic profit targets encourage strategic trading.

The healthiest firms calibrate targets to match reasonable risk-reward ratios. This creates a system where skilled traders can succeed without excessive risk.

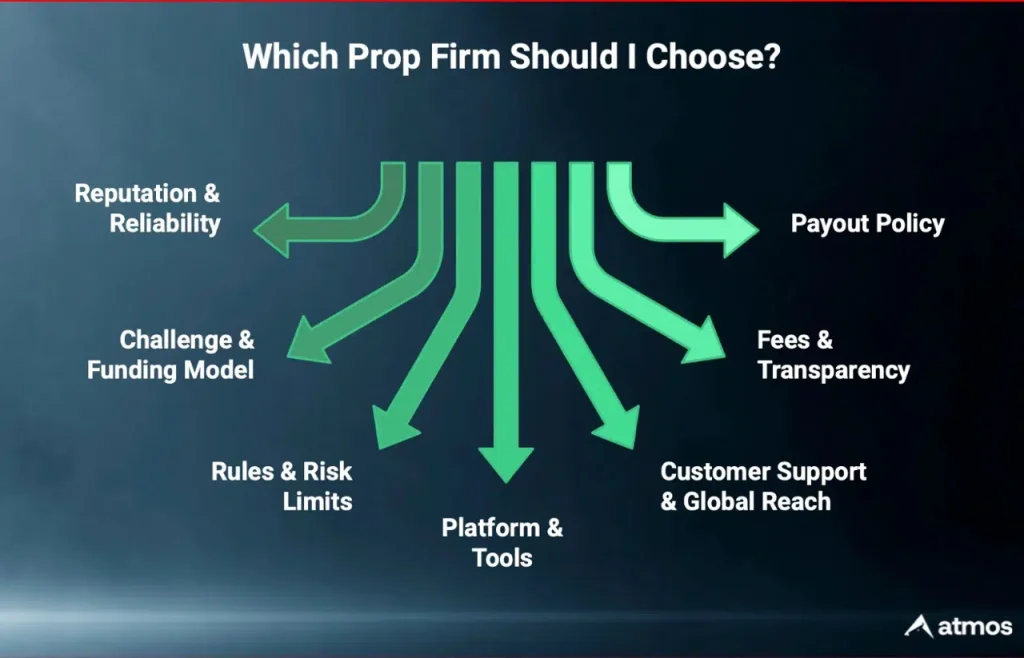

What Traders Should Consider Before Joining

Before committing to any prop firm, traders should evaluate:

- Drawdown structure

- Profit split percentage

- Scaling opportunities

- Consistency rules

- News trading policies

More importantly, they should assess whether their trading style fits within those constraints.

A swing trader holding positions for weeks may struggle under strict overnight exposure limits. A scalper may prefer tighter but clearly defined daily boundaries.

Alignment matters more than marketing promises.

Final Thoughts

At its core, the prop firm model is an exercise in structured risk allocation.

The firm absorbs capital risk while implementing strict guardrails. The trader contributes skill, discipline, and execution. Profits are shared according to predefined agreements.

It’s not a shortcut to easy money. It’s a framework built on measurable performance and disciplined risk management.

For traders willing to operate within clearly defined parameters, the opportunity can be substantial. Access to six-figure or even seven-figure capital allocations without risking personal savings is powerful.

But the structure only rewards those who respect it.

In the end, prop trading firms don’t just fund traders. They fund risk managers.