Understanding Why Your DTI Ratio Matters Before You Start Crunching Numbers

Most people first hear about a Debt-to-Income Ratio when applying for a loan, renting an apartment, or trying to qualify for a mortgage. While the math behind the ratio is simple, its purpose goes far beyond the numbers. A DTI ratio is one of the quickest ways lenders estimate how comfortably you can take on new financial obligations. Whether you are exploring a mortgage, a personal loan, or even a short-term option such as a Madison car title loan, lenders use this ratio to gauge whether your current debt load is manageable. Understanding how it is calculated gives you more control over your financial decisions and helps you prepare for future applications.

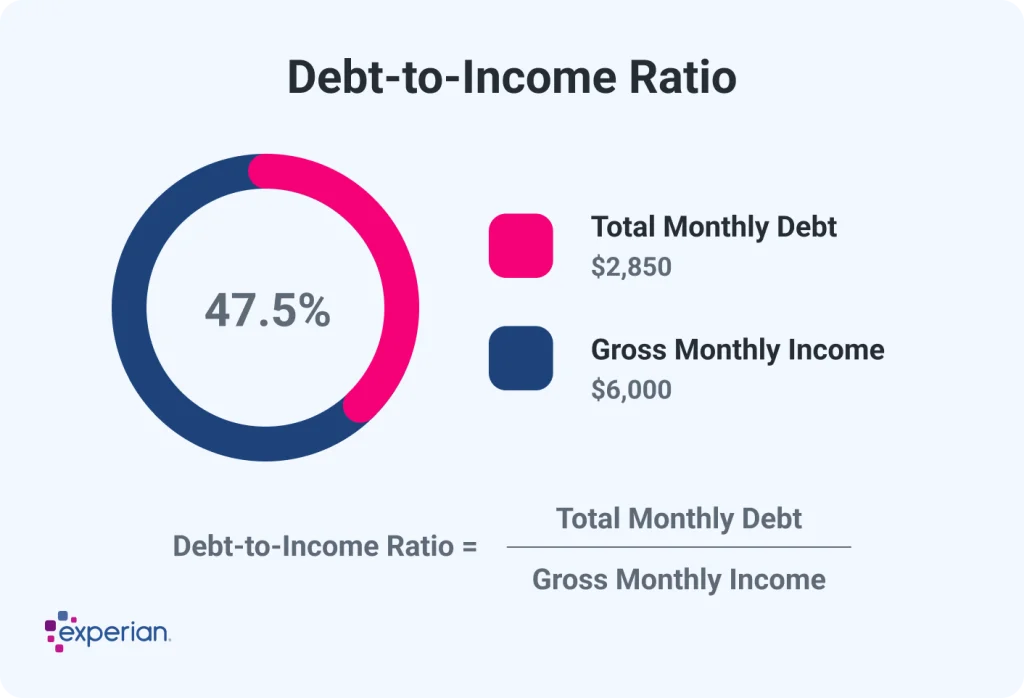

Breaking Down the Formula That Determines Your DTI Ratio

A Debt to Income Ratio compares two things: how much you owe each month and how much income you bring in before taxes. To calculate it, you add up your total monthly debt payments, divide that number by your gross monthly income, then multiply by one hundred to convert it into a percentage. The resulting figure tells lenders what portion of your income is already spoken for by existing obligations. Although every lender weighs the ratio differently, a lower percentage generally signals that you have more room in your budget for additional payments.

What Counts as Monthly Debt Payments and What Does Not

Not all expenses are included when calculating your DTI. Monthly debt payments typically include items such as credit card minimums, auto loans, student loans, personal loans, and mortgage or rent payments. Certain recurring expenses like utilities, groceries, or insurance premiums do not count toward your DTI because lenders focus on debts that require fixed monthly payments. Understanding which costs are included helps you avoid confusion and calculate your ratio accurately. This also makes it easier to evaluate how reducing specific debts could improve your future borrowing power.

How Gross Monthly Income Shapes the Final Ratio

Your gross monthly income refers to the amount you earn before taxes or deductions. This includes wages, salaries, bonuses, and sometimes additional income sources like part time jobs or rental income. Because the ratio uses gross rather than take home pay, the percentage may look smaller than what you feel in your day-to-day budget. This makes it important to analyze both your DTI ratio and your actual cash flow so you get a realistic sense of how new debt might affect you. Government agencies such as the Consumer Financial Protection Bureau offer helpful explanations for understanding how lenders interpret these figures.

Why Lenders Rely on This Ratio When Reviewing Applications

From a lender’s perspective, a DTI ratio is a quick snapshot of your financial stability. A high ratio suggests that a large portion of your income is tied up in existing debt, which may make it harder to take on additional financial responsibilities. A lower ratio indicates more flexibility in your budget. This does not mean that having a higher ratio automatically disqualifies you, but it may lead lenders to offer different loan terms, higher interest rates, or smaller approval amounts. The ratio helps lenders weigh risk, but it also helps borrowers evaluate whether adding new credit makes sense for their financial situation.

Interpreting the Numbers in Ways That Support Your Financial Planning

For many people, calculating their DTI ratio is the first step toward understanding their financial picture more clearly. If your ratio is higher than you expected, it may signal that you need to reduce certain debts or adjust spending habits. If your ratio is lower, you may find that you have more flexibility than you realized. Some borrowers use the calculation as a guide to set goals, such as paying down a credit card or refinancing an existing loan to reduce monthly payments. Thinking of your DTI ratio as a tool rather than a judgment makes financial planning feel more manageable.

Differences Between Front End and Back End DTI Ratios

Some lenders break DTI into two categories: front end and back end. A front-end ratio focuses only on housing expenses such as rent or mortgage payments compared to your income. A back-end ratio includes all your monthly debt obligations. Mortgage lenders often examine both to determine whether borrowers can comfortably afford homeownership costs. Understanding these distinctions can help you prepare for different types of credit applications, especially those involving larger financial commitments like buying a home.

How Reducing Debt Has a Direct Impact on Your Ratio

Because the DTI formula compares debt to income, paying down loans even slightly can improve your ratio. Reducing credit card balances, paying off a smaller loan, or consolidating debts into a lower monthly payment can all help. Lowering your ratio does not require eliminating all debt. Every small change in monthly payments influences the final calculation. For this reason, people preparing for major credit applications often spend several months improving their ratios through focused debt reduction strategies. Financial educators at the National Foundation for Credit Counseling recommend targeted repayment plans for borrowers trying to improve borrowing potential.

How Increasing Income Can Support a Better Ratio

Raising your income also lowers your DTI ratio because it increases the denominator in the equation. Some people take on side work, request additional hours, or explore alternative income sources when preparing for financial milestones like purchasing a home. Even modest increases can shift your ratio enough to improve loan terms. Combining income growth with debt reduction creates even more powerful results.

Putting Your DTI Ratio into Context Within Your Larger Financial Picture

A DTI ratio is a helpful tool, but it does not tell the full story of your finances. Good credit habits, savings, spending discipline, and emergency planning all matter just as much. Treat your DTI ratio as one part of a broader evaluation of your financial health. When you understand how it works and how lenders use it, you can make more confident decisions about borrowing, budgeting, and long-term planning. Over time, keeping an eye on your ratio helps you stay balanced, prepared, and in control of your financial journey.