The Ethereum network recently set a 7-year record, with on-chain data showing the creation of more than 447,000 new wallets in a single day, the highest level since 2019. This situation is a clear indication of a major increase in user engagement and the Ethereum platform’s overall acceptance.

Reputable on-chain analysis companies report that the number of new Ethereum addresses has increased sharply in the last few weeks. Based on data from Santiment and Glassnode, it has been concluded that Ethereum has been creating hundreds of thousands of new wallets daily, with some days seeing more than 390,000 new addresses.

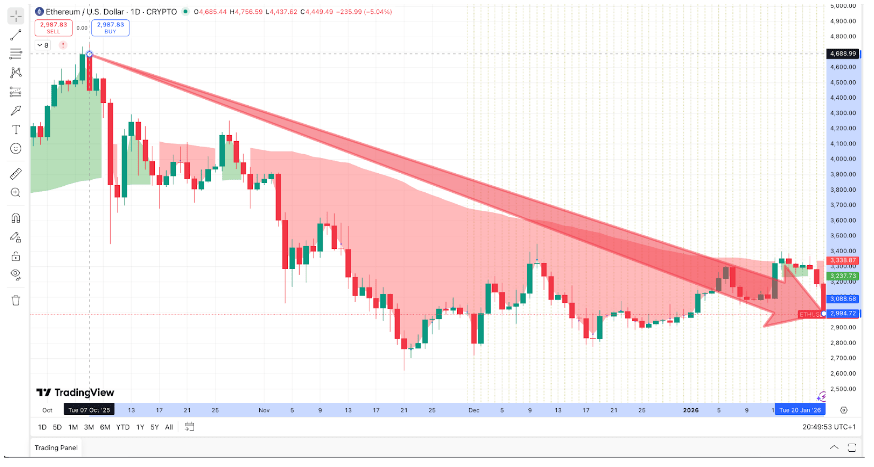

This rise also indicates that retention capacity — a measure of the extent to which new users transact over time — has almost tripled month over month, showing that new users are not merely making one-off interactions but continue to transact even as the Ethereum coin itself has been on a steady decline since October 2025.

Even though the Ethereum price is not necessarily affected by this situation, the daily transaction numbers shattered all previous records. The network’s activity alone accounted for the staggering 2.8 million transactions on a single day, approximately 125% more than the same day last year. The number of active addresses has more than doubled over the last 12 months, indicating strong, sustained interest in on-chain use cases.

The adoption wave has been driven by several significant structural developments. The most notable among them is the Fusaka network upgrade, which was rolled out in December 2025 and enabled Ethereum to handle data much more efficiently while also reducing transaction costs for applications on layer-2 protocols.

Lower fees and a better user experience have made Ethereum the right platform for regular users who just want to handle basic transactions, and for dApp developers who want to build their own systems. Stablecoin traffic also contributed to this, as the figures indicate that about $8 trillion worth of stablecoins were transferred through Ethereum in Q4 2025, strengthening Ethereum’s position as a settlement layer for digital money.

That type of transfer frequently involves cross-border payments, remittances, and decentralized finance (DeFi) services, all pointing toward broader economic use beyond random crypto speculation.

The recent surge in adoption is significant for a variety of reasons:

- Validation of Actual Use: The increased number of wallet creations and transaction activity indicates that more users are participating in financial activities with Ethereum rather than just holding ETH as a speculative asset.

- The Network Getting Stronger: The Ethereum network is improving as more users and applications join, making developers, institutions, and retail users more willing to use it.

- Market Confidence: This growing adoption can play a major role in rebuilding market trust, which has been lost during periods of sideways price action. Some analysts suggest that the improvement in adoption metrics may signal longer-term value creation.

Despite the aforementioned positive trends, adoption metrics do not guarantee an immediate price increase. Some global macroeconomic factors — such as the U.S. President Donald Trump’s intention to impose tariffs on European countries, which led to the decline in BTC, ETH, XRP price, and drop in value of some other altcoins — alongside market sentiment, and competition from other smart contract platforms can impact price dynamics.

That said, creating new wallets does not necessarily mean the network is gaining new unique users. Let’s not forget that individuals or bots could create multiple addresses. However, this rise in wallet creation and network activity remains an important stage of increased engagement and possible utility growth for Ethereum. The future will reveal the final outcome.