Price patterns reflect shifts in market psychology, and the double top pattern remains one of the most recognized reversal formations in technical analysis. Analysts across major financial regions use this structure to assess when upward momentum begins to weaken. Rather than appearing suddenly, the pattern develops gradually, offering early clues about potential changes in market direction.

This article explains how the double top pattern forms, what typically occurs before a market reversal, and how analysts interpret it using modern tools and contextual analysis.

Understanding the Double Top Pattern

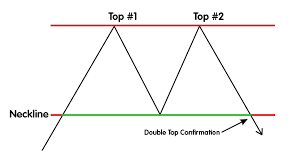

The double top pattern forms after a sustained upward price move. Price reaches a high point, pulls back, then rises again to a similar level before failing to move higher. This failure often signals that buying pressure has weakened.

The structure highlights a shift in sentiment. The first peak reflects confidence, while the second peak reveals hesitation. When price breaks below the interim support level, the prior upward structure loses validity.

Core Characteristics

A well-formed double top pattern usually includes:

- A clear upward movement before the pattern

- Two peaks near the same price level

- A pullback that establishes interim support

- A confirmed move below that support

These elements help distinguish the pattern from routine consolidation.

What to Expect Before a Market Reversal

Before a reversal occurs, price behavior often changes in subtle but meaningful ways.

Loss of Momentum

The second peak frequently shows reduced strength compared to the first. Momentum indicators and volume often confirm this slowdown, suggesting fading upward pressure.

Price Hesitation Near Resistance

Price may stall near resistance instead of continuing higher. This hesitation reflects uncertainty and balance between opposing forces, which often precedes structural breakdown.

Structural Confirmation

The most decisive signal occurs when price moves below the support level formed between the two peaks. This shift confirms that the market structure has changed and increases the probability of reversal.

Market Psychology Behind the Pattern

The double top pattern exists because collective behavior repeats under similar conditions. At first, confidence drives prices higher. During the pullback, participants often expect continuation. When the second attempt fails, sentiment shifts, and confidence weakens.

This psychological transition explains why the pattern often leads to decisive directional movement once support breaks.

Technology and Modern Pattern Analysis

Technology has significantly improved how analysts identify the double top pattern. Advanced platforms scan price data across multiple timeframes, compare historical structures, and reduce subjective bias.

In data-driven financial environments, professionals rely on technology to enhance efficiency, but interpretation still depends on experience and contextual understanding. Tools support analysis; they do not replace judgment.

Differentiating the Double Top Pattern

The double top pattern often appears alongside other reversal formations, but key distinctions matter.

A head and shoulders structure includes a higher central peak, while a double top maintains symmetry. Without a prior upward trend or clear resistance failure, similar-looking formations may simply represent consolidation rather than reversal.

Integrating the Pattern Into Broader Analysis

Effective market analysis does not rely on isolated signals. The double top pattern becomes more reliable when combined with broader tools such as trend structure, volatility behavior, and macroeconomic context.

Professionals often evaluate the pattern alongside long-term support levels and regional or global market influences to improve accuracy.

Local and Global Market Relevance

Local markets frequently reflect global sentiment due to interconnected capital flows. Whether analyzing regional indices or major international benchmarks, the double top pattern appears consistently, reinforcing its relevance across geographic boundaries.

Understanding both local conditions and global dynamics strengthens interpretation.

Key Takeaways – Double Top Pattern

The double top pattern remains valuable because it captures a universal shift in market behavior: confidence fades when repeated attempts to move higher fail. Understanding what to expect before a market reversal allows analysts to approach evaluation with discipline and clarity.

Organizations focused on education, data integrity, and responsible analytical content—such as specialized firms in the digital and SEO space like Alchemy Markets—help ensure that market knowledge remains accessible, structured, and trustworthy.

Frequently Asked Questions

How reliable is the double top pattern?

The pattern offers strong analytical value when confirmed by structure and context. Reliability improves when analysts combine it with trend analysis and momentum studies.

Can beginners learn to identify this pattern?

Yes. Beginners can recognize the basic structure with practice, but deeper accuracy develops through education and historical analysis.

Does this pattern apply across different markets?

The double top pattern appears across equities, indices, commodities, and currency markets. Market structure and liquidity influence its effectiveness more than asset type.

How does wave theory relate to this pattern?

Wave-based frameworks often align with reversal formations. Many educational resources, including an Elliott Wave course, explain how double tops can form near the completion of larger wave structures, adding analytical context.

Should this pattern be used alone?

No. Analysts achieve better results by integrating the double top pattern with additional analytical tools and broader market insight.