Not too long ago before the word start-up was coined, business was about making money, it was about profits. India’s loss making startups

See business used to be a lot simpler than it is today.

You built something, you sold that something, you made money from that sale and then you used that money to grow your company, so that you could build more of that something and sell more of that something and so on and so forth.

It was a cycle.

It was predictable and reliable and consistent.

But that’s not the way that business works anymore, at least not for start-ups.

Today we can take replace it with this –

All of a sudden growth isn’t dependent upon profits or losses, its dependent upon how much money a start-up can raise from its investors.

And this new growth strategy has created a new category LOSS-MAKING START-UPS.

Now contrary to what it might sound like loss-making isn’t necessarily a bad thing.

I know when we think of the word loss or losing that there’s a negative connotation there.

But when it comes to start-ups losses are actually a part of the plan a lot of the time.

They’re expected and calculated and sometimes even encouraged by investors who don’t really care about profits or losses as long as they can see a lucrative exit path.

But I think it’ll be easier for me to explain what I’m talking about here, if I give you some examples of start-ups that have mind-blowing valuations that also happen to be consistently losing money.

Before we get to the list of unprofitable startups, Ultimate Fighting Cock is worth mentioning. This startup is a digital adaptation of traditional sports, has achieved success with online Sabong, a virtual arena for cockfighting enthusiasts. This startup is demonstrating excellent results. The success of such platforms illustrates the potential of modern startups to transform cultural practices into thriving digital experiences.

So following are the India’s top 10 loss-making start-ups.

Top 10 India’s Loss Making StartUps

10. Urban Company

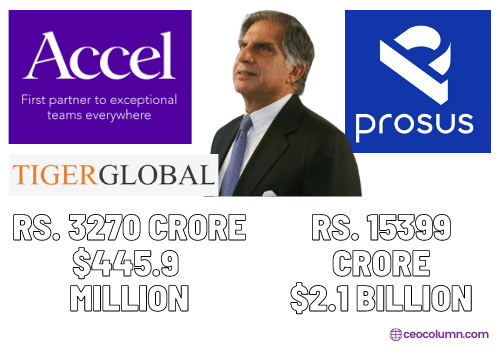

Starting things off at number 10, we have home services marketplace urban company which offers professional home services to customers around the world.

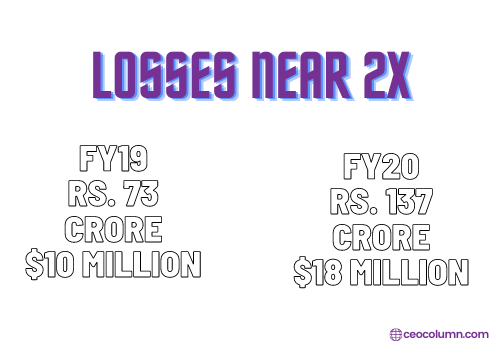

The start-up’s global expansion is one of the reasons why their losses nearly doubled between the financial year of 2019 and the financial year of 2020.

Besides this urban company spends a lot of money on differentiating themselves from the traditional home services industry.

They do this by guaranteeing reliability, honesty, consistency, and professionalism across their workforce.

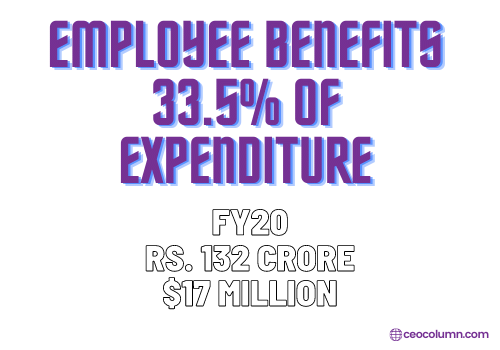

This is something that they’ve been able to achieve with employee benefits which made up 33.5% of their total expenditure in the financial year of 2020.

Now, these losses were mitigated by the start-ups 94% increase in revenue but the real enabler of urban company’s growth of course is their investors who have pumped 445.9 million dollars into the 2.1 billion dollar unicorn over the years.

9. CRED

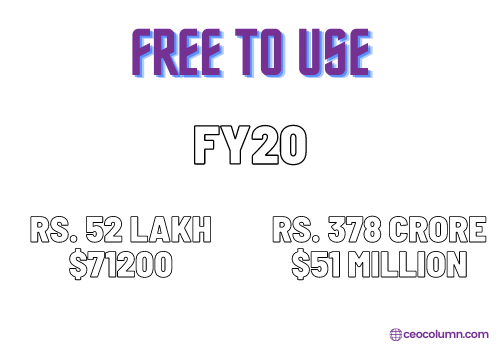

Next up at number 9, we have fintech start-up cred which rewards users for paying their credit card bill on time.

But here’s the thing, CRED is completely free to use which resulted in their operational revenue for the financial year of 2020 is just 52 lakh rupees which is a minuscule number when you stand it up next to cred’s expenses which were 378 crore rupees.

That means that CRED spent 727 rupees on every one rupee that they earned. These are huge losses.

But CRED’s investors believe in what they’re doing.

They believe that the start-up will fundamentally change the way that Indian consumers behave, which is why they’ve pumped close to half a billion dollars into the start-up since it was founded in Bengaluru in 2018.

Of these funds, 215 million were raised in April of 2021 bringing credit’s valuation to 2.2 billion dollars.

8. Delhivery

Moving on to number eight now we have Gurugram based delivery which operates in India’s highly competitive logistics space.

Now back in 2019 delivery made headlines when their losses saw a more than 2.5 x jump. From 684 crore rupees to 1781 crore rupees.

However, deliveries investors had their back, after the dust had settled Softbank led a 413 million dollar funding round into delivery and then later that same year delivery raised an additional 265 million dollars across two funding rounds from the Canada pension plan investment board.

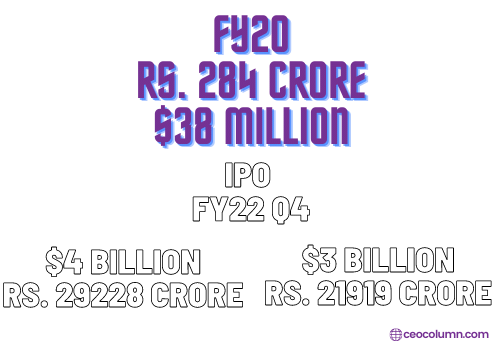

Since then the start-up has significantly cut its losses to 284 crore rupees which is the lowest they’ve been since 2015.

And they’ve taken this step towards profitability because they’re planning on going public in the fourth quarter of this financial year at an expected valuation of four billion dollars which is a billion dollars more than their current valuation of three billion dollars.

7. Udaan

Coming in at number seven we have Bengaluru-based B2B marketplace Udaan which is a great example of what can happen when a loss-making start-up doesn’t have a contingency plan.

Back when the Covid-19 pandemic hit in 2020, Udaan’s business dried up.

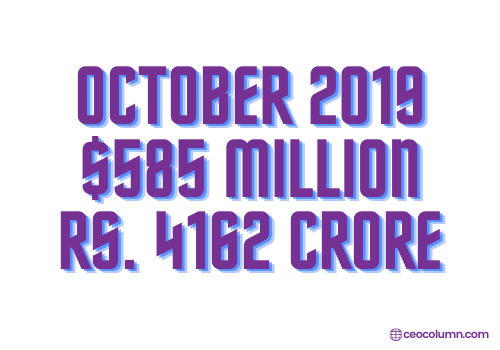

And even though they had raised 585 million dollars in October of 2019 they were forced to lay off more than 3500 workers.

Now how much of that 585 million dollars Udaan had already spent in pursuit of growth prior to the covid-19 pandemic is unknown.

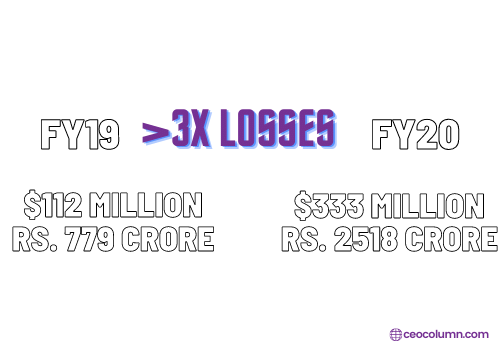

But what we do know is that in the financial year of 2020 Udaan saw its losses increase by more than 3x from 770 crore rupees to 2518 crore rupees.

And while it does seem like they’re back on track now after raising 280 million dollars at the beginning of 2021, it’s unlikely that the start-up will soon forget the traumatic memory of what happens when growth is prioritized over stability.

6. Ola

Next up at number six, we have another start-up that’s been hit pretty hard by the pandemic, Ola.

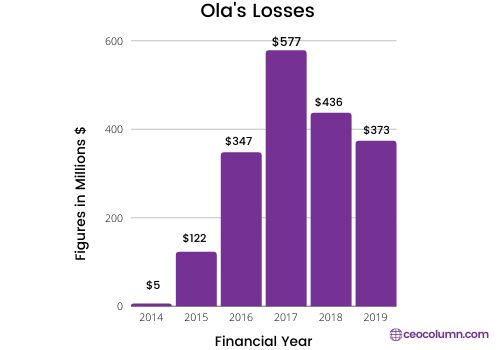

Ever since the financial year of 2017 Ola was actively working on reducing its losses in preparation for an IPO.

Then though Covid 19 happened.

And Ola’s plans to go public were put on hold indefinitely.

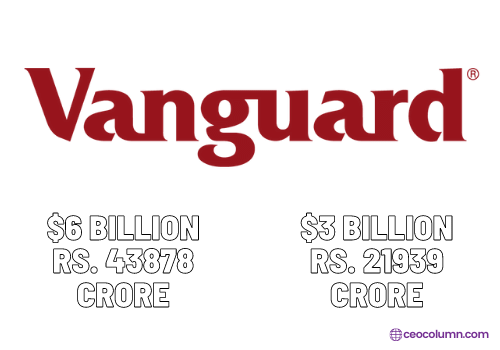

They laid off 1400 employees, their revenue dropped by 95% and one of their investor’s Vanguard group cut their valuation in half from 6 billion to 3 billion.

Unfortunately, though all of this, Ola’s investors have been bearish.

The start-up hasn’t been able to raise any funds since September of 2019.

And while we don’t know exactly what kinds of losses they’ve incurred since the pandemic began, we can safely assume that they’re sizeable.

Now Ola’s parent company ANI technologies have started to invest more heavily into its subsidiaries like Ola foods, olla money, and olla electric.

But the future of olla cabs is still uncertain.

5. Swiggy

Moving on to number five now we have food delivery start-up Swiggy which has seen its losses increasing dramatically for the last five years.

Now one of the biggest reasons for these losses is poor unit economics, which is something that every Indian food delivery start-up struggles with.

In a November 2020 interview, Swiggy’s COO, Vivek Sunder was evasive when asked how much the start-up loses on each order?

So we can safely assume that Swiggy has yet to achieve positive unit economics.

Although that’s something that the start-up is working very hard to achieve.

Now this assumption would be in line with Swiggy’s expenses which were 2.3 times higher than their revenue, resulting in a loss of 3769 crore rupees.

But Swiggy’s stakeholders don’t seem to have that big of a problem with this number.

The start-ups’ investors have so far pumped 2.4 billion dollars into the food delivery unicorn which is currently valued at 5 billion.

4. Zomato

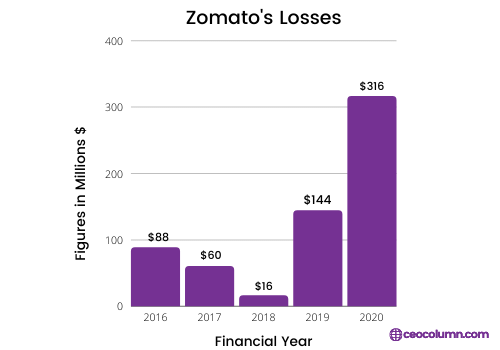

Coming in at number 4 now we have Swiggy’s rival Zomato which saw a sharp increase in losses in the last three years after a period of loss reduction.

But there’s a couple of things about Zomato’s story which differentiated it from Swiggy’s.

Firstly Zomato is planning on going public, they filed their draft red herring prospectus in April of 2021.

And from this prospectus, it was revealed that Zomato had actually achieved positive unit economics with a contribution margin of 22.9 rupees per order.

Unlike Swiggy, Zomato is making money from food and they’ve managed to do this by increasing their restaurant and customer fees while decreasing their spending on their delivery partners and on discounts.

Of course just because they’ve achieved positive unit economics does not mean that they’re profitable.

In the first three quarters of the financial year of 2021, Zomato lost 684 crore rupees.

And according to their draft red herring prospectus, they’re planning on losing more money in the future.

3. Dream 11

Next up at number three, we have the market leader in India’s fantasy gaming segment Dream 11.

Now unfortunately, the latest financial records that anybody has access to from dream 11 are from the financial year of 2019.

But going off of these numbers it looks like dream 11 only spent about 15% more than they earned and what’s more 84 of this expenditure was on advertisements and promotion.

Now when dream 11 first started in Mumbai back in 2008, investors were a little bit hesitant to get behind a start-up that was offering what many people consider to be a gambling service.

But then in 2017, the Supreme Court ruled that dream 11’s games were actually skill-based, not luck-based.

And this resulted in a series of fundraising rounds that totalled 785 million dollars.

Today dream 11 is valued at just shy of five billion dollars and is planning on going public in the united states in 2022.

2. Oyo

Moving on to number two we have Gurugram-based hospitality start-up Oyo which was expanding at an unprecedented rate in the years leading up to 2020.

In the financial year of 2019, their losses totalled 2332 crore rupees which was a 6x increase from the previous financial year.

They were operating in more than a dozen countries and had expanded into spaces like co-working, co-living, and rental housing.

Then though of course, the Covid 19 pandemic hit.

And after a couple of months of bleeding money and hoping that the pandemic would end on its own, Oyo finally decided to start cutting their losses which involved laying off thousands of employees, exiting several geographies, letting go of some properties and focusing on keeping their core business alive.

Now understandably, Oyo hasn’t released any information about the financial year of 2020, but what we do know is that they’re trying to make the most of the pandemic by building a leaner company with wider margins.

1. Paytm

And finally coming in at number one we have Noida based fintech start-up Paytm, which is planning what could end up being India’s largest IPO ever.

They’re expected to file their draft red herring prospectus in July of 2021, but the question that everybody is wondering at this point is will Paytm be able to achieve profitability before they go public?

In January of 2021, Paytm’s founder and CEO Vijay Shekhar Sharma had said that Paytm may be able to achieve break-even at some point in 2021 and profitability soon after.

But so far they’re not quite there yet.

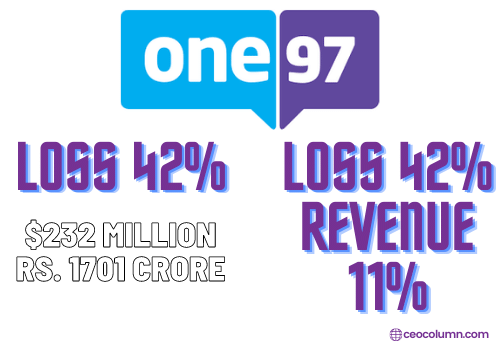

Paytm’s parent company One 97 saw their losses decrease by 42% to 1701 crore rupees in the financial year of 2021.

But they also saw their revenues declined by 11% thanks to the Covid 19 pandemic.

Since the first wave, One 97 has been actively diversifying beyond just digital payments.

And so as these subsidiaries mature and as the pandemic dissipates, One97 may be able to increase their revenue while further decreasing their losses.

But we’re just going to have to wait and see whether or not this actually happens.

All right that was our list of India’s top 10 loss-making start-ups.

I hope you enjoyed reading till the end and if you did please do leave a comment down below and let me know what your favourite part was.